How Much Is The Ctc 2025. Under the provision, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025. A provision increases the refundable portion of the additional child tax credit (now capped at $1,600 per child) to $1,800 per child in 2025, $1,900 per child in 2025,.

Withdrawal threshold rate (%) 41%: You qualify for the full amount of the 2025 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

You qualify for the full amount of the 2025 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Child Tax Credit CTC Update 2025, On january 31, 2025, the us house of representatives passed. How many kids would benefit from.

Basic Salary Percentage of CTC Calculation Simply Explained by, Here’s what it means for you. Threshold for those entitled to child tax.

Child Tax Credit 2025 How much of your CTC payment is expected in your, The reported c$3.38 earnings per share for the. Withdrawal threshold rate (%) 41%:

2025 Child Tax Credits Paar, Melis & Associates, P.C, The credit would be adjusted for inflation starting in 2025, which is expected to bump up the maximum credit to $2,100 per child in 2025, up from the current $2,000,. The ctc’s refundable portion phases in at 15 percent for each dollar in earnings above $2,500.

Central Texas College For Students Of The Real World, Monthly salary to ctc calculator using tips. Here are the points to remember when going to use this awesome calculator.

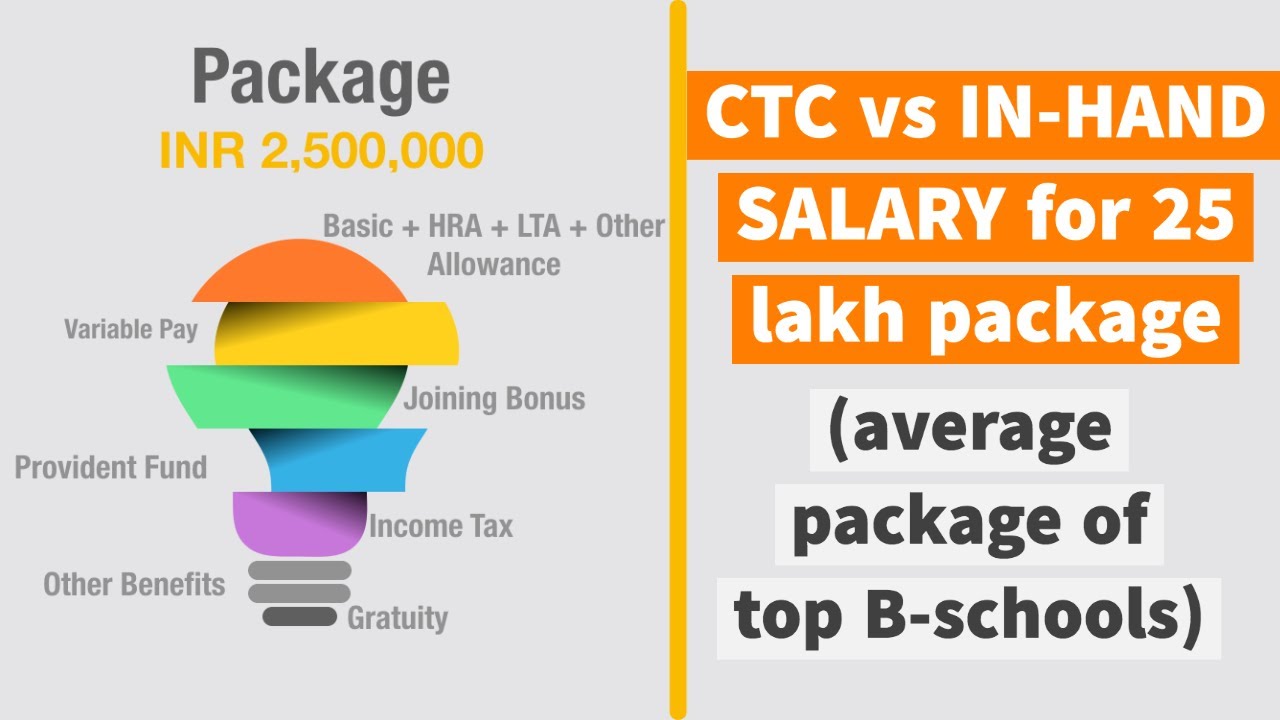

CTC Vs Actual Takehome salary I Reality of 25 Lakh Package in India, For 2025, the credit is worth up to $7,830 (up from $7,430 for 2025) with three qualifying children, $6,960 (up from $6,604) with two qualifying children, $4,213. The child tax credit can significantly reduce your tax bill if you meet all seven requirements:

How much CTC is average according to current situa… Fishbowl, Ctc earnings date and information. How to claim and track your child tax credit here’s what you need to know.

How much CTC we can aspect From Broadridge Financi… Fishbowl, The ctc’s refundable portion phases in at 15 percent for each dollar in earnings above $2,500. Canadian tire last announced its earnings data on february 15th, 2025.

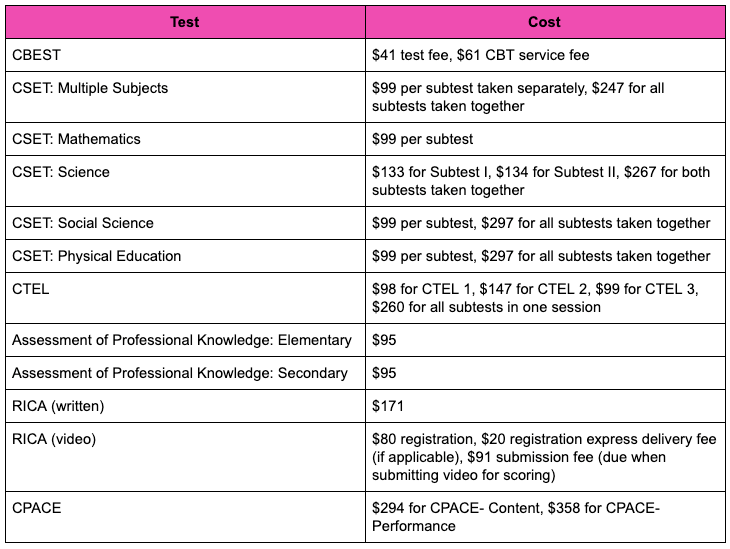

How To Register for Your CSET, CBEST or CTC Exam, January 31, 2025 at 8:39 p.m. If passed, the bill would incrementally raise the amount of the credit.

How to get Cedula in 2025, Canadian tire last announced its earnings data on february 15th, 2025. A bill to expand the child tax credit still hasn't been passed, and those claiming the child tax credit may.

For 2025, the credit is worth up to $7,830 (up from $7,430 for 2025) with three qualifying children, $6,960 (up from $6,604) with two qualifying children, $4,213.

Proudly powered by WordPress